How Plus 1 Group Can Help Grow Your Wealth

How Plus 1 Group Can Help Grow Your Wealth

Navigating the complex world of finances can be overwhelming, especially for businesses and individuals in Shepparton and across Victoria. That’s where Plus 1 Group comes in. As your local accountants in Shepparton, we are dedicated to providing comprehensive financial solutions tailored to your specific needs.

What Does Plus 1 Group Offer?

We play a crucial role in managing your financial health. Our services encompass a wide range of activities, including:

- Taxation: Preparing and lodging tax returns for individuals, businesses, and partnerships. We stay up-to-date with tax laws to ensure you maximise deductions and minimise liabilities.

- Accounting: Maintaining accurate financial records, preparing financial statements, and providing insights into your business’s financial performance.

- Business advisory: Offering strategic advice on business planning, growth strategies, and financial management. We can help you make informed decisions to achieve your business goals.

- Bookkeeping: Recording financial transactions, reconciling accounts, and managing payroll. We can streamline your bookkeeping processes and ensure accurate financial data.

- Auditing: Examining financial records to verify their accuracy and compliance with accounting standards.

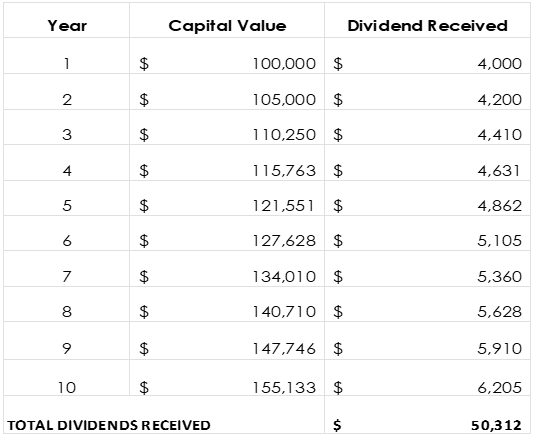

- Financial planning: Developing strategies to achieve your financial goals, whether it’s saving for retirement, buying a home, or investing.

Why Choose Plus 1 Group in Shepparton?

At Plus 1 Group – your local accountants in Shepparton we understand the unique challenges faced by individuals and businesses throughout Victoria. Our team of experienced accountants is committed to providing personalised service and building long-term relationships with our clients.

Here’s why you should choose us:

- Local expertise: We have in-depth knowledge of the Shepparton and Victorian business environment and can provide tailored advice.

- Comprehensive services: Our wide range of services ensures all your financial needs are covered under one roof.

- Client-focused approach: We prioritise your financial goals and work closely with you to achieve them.

- Up-to-date knowledge: We stay informed about the latest tax laws and financial regulations to provide accurate and timely advice.

- Technology-driven solutions: We leverage the latest accounting software to streamline processes and improve efficiency.

Whether you’re a small business owner, an individual seeking tax advice, or a growing enterprise, Plus 1 Group is here to support your financial success. As Shepparton’s trusted accountants we believe in building strong partnerships with our clients, providing proactive advice, and helping you make informed decisions.

Contact us today to schedule a consultation and discover how we can assist you. Email or call our friendly team at Plus 1 Group on (03) 5833 3000.

Need more help or information?

Click the link below to contact us at Plus 1.

Open Hours

Monday to Friday

8:00am to 5:00pm

Closed Public Holidays

If you need to get us documents quickly, access remote support, or the MYOB Portal click the button above.

Recent Comments