The case for a growing income stream

Sometimes it is easy to forget or not consider the TOTAL RETURN from an investment portfolio.

We may focus so much on the:

- Rental income of an investment property

- The dividends from our share portfolio

- The coupon payments from a government bond

- The income being paid on a pension or annuity

- The interest being received on a term deposit

All important as the income invariably provides income for our living expense/lifestyle needs especially for retirees/part time workers or just those solely reliant on returns on their investments to live.

Obviously for investments such as property and shares we also have the growth of the investment occurring (hopefully). Of course at differing times we may need to draw on the growth by selling some of the investments especially with shares (gradual sales) whereas with property not so easy as all or nothing. A subject for another day.

The intention of this article is to focus on the need for A GROWING INCOME STREAM in the main. In other words if I had a say $100,000 share portfolio paying dividends on average of 4% per annum (exclude any tax or franking for this illustration) then that is $4,000 per annum. If the dividend is taken then that’s fine and you still have the $100,000 working for you.

What we do want however is that that dividend/income stream grows as well (or similarly with rental property the rent amount grows each year).

So say for instance the share price grew and the investment was say 5% higher a year later (in addition to the 4% dividend paid) then you would reasonably expect the second year dividend to be $100,000 times 4% times 1.05 being now $4,200.

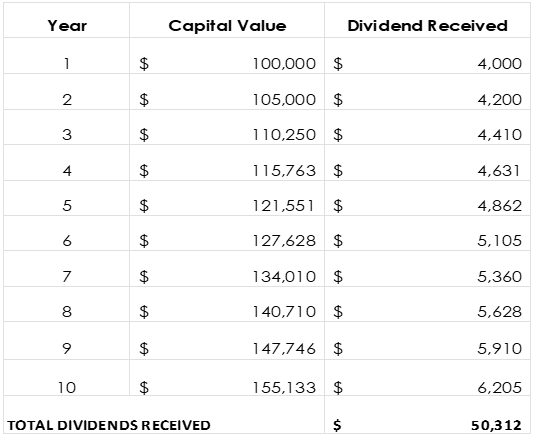

Extrapolate that out say 10 years then with similar growth (for the purposes of this exercise) then after 10 years you would expect the dividend payment to be $6,205 as below. Based on the assumption that the companies within the portfolio continue to produce profits and distribution of these profits is consistently done.

So dividends were not just $10,000 (10 times $4,000) but $50,312.

The concept is the same for residential investment property where you would ideally want rents to keep pace with inflation or growth in the property – within reason.

All goes well why growth assets in a portfolio are a very important part so as supporting a:

GROWING INCOME STREAM

At Plus1, we are available at any time to discuss issues of this nature, with due regard to your investments or financial planning generally.

Need more help or information?

Click the link below to contact us at Plus 1.

Open Hours

Monday to Friday

8:00am to 5:00pm

Closed Public Holidays

If you need to get us documents quickly, access remote support, or the MYOB Portal click the button above.